Strong Spring on Bratislava’s Residential Market – Units Sales Up 60% Compared to Q1

Following a slowdown due to the VAT increase in Q1, the residential

market in Bratislava rebounded sharply. In Q2 2025, a total of 797 units

were sold through public sales – nearly 60% more than in the previous

quarter, making it the second strongest quarter in the past four years.

The average asking price rose moderately to €5 500€/m², while the available supply remained stable at around 3,250 units. Most transactions occurred in the €200,000–400,000 price range, with the luxury segment growing at a slower pace. This trend is also reflected in the best-selling projects, which are mostly located on the outskirts of the city.

BuiltMind, in cooperation with consultancy firm Cushman & Wakefield, has released a new report providing a detailed overview of the current state of the residential market in Bratislava. BuiltMind tracks units sales using proprietary software that monitors publicly available data from developers’ websites – specifically units removed from price lists or marked as sold. The tool covers more than 100 different residential projects across the city. Unlike traditional manually gathered reports, this data is collected automatically and verified with major developers. BuiltMind also monitors private sales, which are verified with all major residential developers. Cushman & Wakefield, although focused primarily on commercial properties, is also active in the residential segment through feasibility studies and project valuations at various development stages, providing a broader market context and insight into current trends.

The available inventory held steady at around 3,250 units – almost identical to Q1 2025. With one in four available units sold during Q2, the absorption rate returned to its long-term average of 25% (24.6% in Q2), marking the second-highest value in the past three years.

The average asking price increased from €5,400/m² to €5,500/m², up 1.9% compared to Q4 2024 – surpassing all previous price peaks.

“This was an exceptionally strong quarter when compared to long-term averages. Following a record-breaking Q4 and an expected drop in Q1, this sharp rebound in sales was surprising and nearly matched the record results seen at the end of last year,” said Martin Decký, CEO of BuiltMind.

The highest price per square meter was recorded in studio (1-room) units, which exceeded €5,750/m², with many listings now priced well over €6,000/m². Larger units (4+ rooms) maintained price stability around €5,000/m², although premium locations, particularly in the Old Town, reached up to €7,100/m².

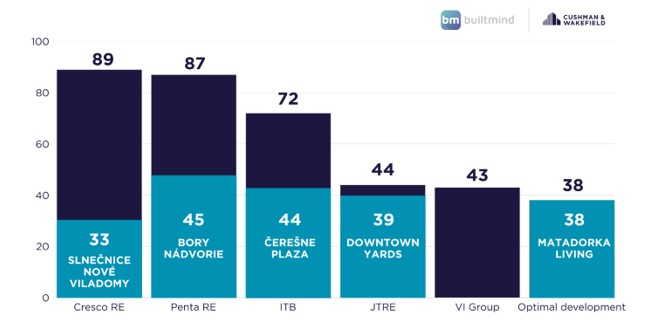

In terms of total sales (both public and private), Cresco Real Estate led the market with 89 units sold, followed by Penta Real Estate (87) and ITB (72). The best-selling projects were the newly launched Bory Nádvorie (45 sales) and Čerešne Plaza (ITB) with 44, while Downtown Yards, Matadorka Living, and Slnečnice – Nové Viladomy also performed strongly.

Total Developer Sales in Q2 2025

Demand continues to focus on smaller units, especially studios and one-bedroom units, which together accounted for nearly 70% of all sales. One-bedroom units alone made up half of Q2’s transactions. Over the past year, 54% of all studio units on the market have been sold, with the smallest units under 35 m² performing even better – roughly two-thirds were sold. The top-selling projects in this category were Čerešne, Bory, and Ovocné sady.

“Buyers increasingly favor smaller, more affordable units, often for investment purposes – a trend further encouraged by falling interest rates. The supply of available housing is gradually adapting to this demand,” added Decký.

The base interest rate dropped again, reaching 2.15%, with the ECB expecting further declines to around 2% by the end of 2025. This has partially translated into lower mortgage rates in Slovakia, with average rates falling by 0.30 percentage points since the start of the year. Some banks are now offering rates below 3.40%. This downward trend in borrowing costs is supporting an increase in residential loan volumes, contributing to rising new-build sales.

BuiltMind expects the market to stabilize at 550–750 units sold per quarter over the next two years. Average prices may reach €5,600/m² by the end of 2025 and approach €6,000/m² during 2026.

Trend in the number of units sold

Global macroeconomic conditions will also play a role. Potential trade tensions or changes in political leadership in major economies could lead to inflationary pressures and slow the expected decline in interest rates. For now, however, the market is benefiting from a positive trend, with rates steadily falling and more reductions expected this year.

The gap between wage growth (approx. 4.7% annually in Bratislava) and property price growth (6–7% annually) is further reducing housing affordability for average households. As a result, these buyers are increasingly turning to smaller, more affordable units. Studio and one-bedroom units remain leaders in both sales and liquidity.

“Over the past 6 to 9 months, several new projects have launched and quickly became best-sellers. Most construction is happening on the outskirts of Bratislava, with high demand for smaller units, especially one-bedroom units. The combination of suburban location, compact size, and lower financing costs is making these units more accessible to a wider group of buyers,” noted Lukáš Brath, Senior Analyst at Cushman & Wakefield Slovakia.

Other factors will also influence the market – for example, a possible end to the war in Ukraine could ease the pressure on the smallest units. Demographic changes and the rising number of single- and two-person households are also fueling demand for well-designed, affordable smaller homes.

***

If you have any questions, please contact:

Tomáš Kajúch, BuiltMind, +421 915 336 551, tomas.kajuch@builtmind.com

Lukáš Brath, Cushman & Wakefield Slovensko, +421 904 325 358, lukas.brath@cushwake.com

Follow us