We explore how Slovak entities can strategically engage in and support Ukraine’s reconstruction, supported by insights from the Center for International Private Enterprise (CIPE), an international non-profit focused on strengthening democracy through market-oriented reform.

The Benefits of EU Accession – An Opportunity for Ukraine

Ukraine’s future accession to the EU and NATO is anticipated to significantly boost the adjacent regions in Central and Eastern Europe. This growth is expected to stem from a massive influx of investments, the post-war renewal of Ukraine’s economy and society, and the return of most people who fled the country since early 2022.

Slovakia celebrated the 20th anniversary of its EU accession on May 1, 2024. On this day in 2004, ten countries, with a combined population of 75 million, joined the EU.

As Figure 1 (GDP Growth Comparison) demonstrates, the avergae annual growth rate2 of the ten accession countries exceeded the EU average by more than two percentage points from 2000 to 2022. These countries have increased their GDP per capita to 82% of the EU average ($46,960) in 2022, compared to just 53% in 1999 ($11,050).

The unemployment rate in the ten accession countries improved significantly, dropping from over 11% in 1999 to 3.5% in 2022.

Despite multiple major crises, the 2019 BREXIT, and the accession of Romania, Bulgaria, and Croatia, the EU maintained an average inflation target of 3% (HICP) over the past 22 years.

Reflecting on the positive effects observed in the ten countries that joined the EU in 2004, and benefits to the Union as a whole, a similar substantial boost is projected with Ukraine’s accession in the coming decade.

Support and Solidarity: An Immense Task and Opportunity

Since February 2022, the EU and its member states have provided or committed over €143 billion to support Ukraine3, including:

- €81 billion in financial, budgetary support, and humanitarian assistance.

- €33 billion in military support.

- €17 billion for refugees within the EU (with an estimated 5,957,301 people fleeing Ukraine as of May 144).

- €12.2 billion in grants, loans, and guarantees provided by EU member states.

On May 14, 2024, the European Council approved the ‘Ukraine Plan’ under the Multiannual Financial Framework Ukraine Facility for 2024 - 2027, allowing up to €50 billion for recovery and EU accession reforms5.

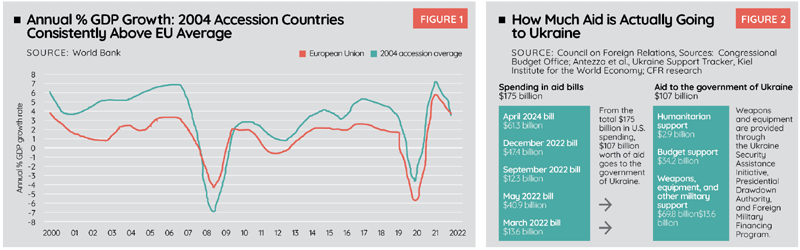

The U.S. has committed $175 billion (€164 billion) across five aid bills6, with $107 billion directly allocated to Ukraine for budget support, military aid, and humanitarian efforts. Additionally, countries such as Canada, Japan, Norway, Australia, Switzerland, and South Korea have also provided substantial financial and military assistance.

The World Bank, the Government of Ukraine, the European Union, and the United Nations estimate that the damage, losses, and recovery needs for Ukraine’s reconstruction over the next ten years amount to €447 ($486) billion as of February 20247, which is approximately 2.8 times the estimated nominal GDP of Ukraine for 2023. This figure is expected to rise due to ongoing Russian aggression.

The funds are allocated across key sectors:

- Housing and Utilities: €73.6 billion for repairing and modernizing residential areas and utilities infrastructure.

- Transport: €68.1 billion to restore and upgrade roads, railways, and other critical infrastructure.

- Commerce and Industry: €62.1 billion to revitalize businesses and stimulate economic activity.

- Agriculture: €51.4 billion aimed at enhancing infrastructure and sustainable practices.

- Energy: €43.3 billion for restoring infrastructure and transitioning to low-carbon sources.

- Social Protection and Livelihoods: €40.4 billion to support vulnerable populations through social welfare, education, and health services.

- Explosive Hazard Management: €32.1 billion for addressing mine clearance for safe living conditions.

- Cross-Sectoral Needs and Other Expenses: €76 billion covering emergency response, justice, public administration, digital infrastructure and other costs.

This comprehensive plan underscores the importance of strategic prioritization and international financial support for Ukraine’s extensive reconstruction needs. Ukraine will manage and request support efforts both (during?) and after the war, continuing this process as it joins the EU and NATO in the coming decades.

Slovak Private Sector Involvement in Ukraine’s Recovery

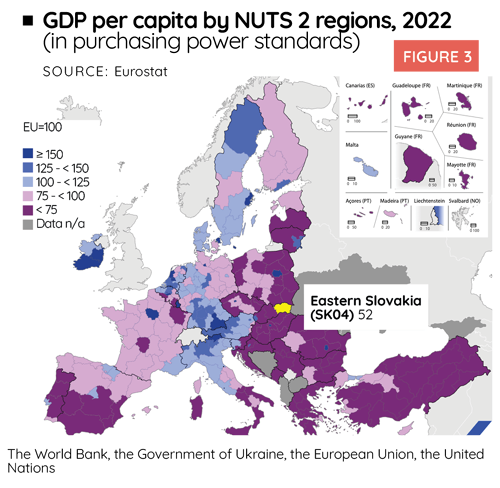

Slovak regions lag behind the EU average in GDP per capita8, with only the Bratislava region exceeding it at 146%, ranking 21st out of 242 EU regions. The most underperforming region is Eastern Slovakia, with the Košice and Prešov regions achieving only 52% of the EU GDP average, similar to the Southern Transdanubia region in Hungary and the Thessaly region in Greece. The least performing continental EU region is the Northwest Planning Region in Bulgaria, reaching only 40% of the EU average.

The Western Slovakia region performs similarly to Apulia in southern Italy or Extremadura in eastern Spain, at 65%, whereas the Central Slovakia region, at 60%, is comparable to the Northwest region in the Czech Republic.

Participation in Ukraine’s renewal efforts is therefore of vital interest to the entire Slovak economy, particularly its enterprise backbone, including industries, service sectors, and SMEs. Given that Slovak regions lag significantly behind the EU average in GDP per capita, it is imperative for Slovakia to seize every available opportunity to catch up. Engaging in Ukraine’s reconstruction will provide much-needed economic stimulation and growth, helping Slovakia to bridge this gap.

CIPE Initiative

To better understand the opportunities and challenges facing Slovak businesses seeking to participate in Ukraine’s reconstruction, CIPE conducted 25 structured interviews with key public and private sector stakeholders9. This research underscores the need for a structured governmental framework, public-private partnerships, and effective use of EU funds. In comparison, countries like Germany, the Netherlands, France, Denmark, and Poland have been more successful due to their efficient use of state programs and export guarantees.

Interviews highlighted the general lack of awareness among Slovak entrepreneurs about existing European and international support schemes designed to facilitate trade and investment in Ukraine and the importance of these initiatives to derisk cross-border business activity. Significant resources and schemes support Ukraine’s recovery, including the Ukraine Facility, with its Pillar II, the Ukraine Investment Framework, aiming for €40 billion in indued investments. Multilateral assistance from the IMF, World Bank, EBRD, and other institutions further bolster these efforts. DG NEAR Ukraine Service in Brussels, part of the EU Commission, emphasizes the need for financial support and risk mitigation for Slovak businesses, noting Slovakia’s bureaucratic and regulatory challenges compared to countries like Germany and Poland. CIPE aims to mobilize Slovak businesses to support Ukraine’s reconstruction by identifying high-impact opportunities, facilitating public-private partnerships, and strengthening the voice of business in the Slovak policy discourse.

A recurring theme across the interviews and analyses is the challenge posed by bureaucratic hurdles, a lack of information, insufficient partnerships with Ukrainian businesses, and fears of corruption. To address these issues, it is crucial to enhance legal and regulatory frameworks, improve bureaucratic efficiency, establish clear communication channels, and provide financial instruments and risk management strategies. Developing tailored financial products and guarantee schemes - particularly for Slovak SMEs - and utilizing available international facilities are vital for mitigating risks in conflict-impacted regions. Engaging the community and local entities ensures that reconstruction efforts are inclusive and meet the actual needs of the Ukrainian populace.

CIPE’s research highlighted Slovak businesses’ readiness for strategic involvement in Ukraine’s reconstruction. Immediate needs focus on infrastructure and humanitarian support, while long-term goals target sustainable development and deeper EU integration. Slovakia’s unique geographical and political position offers an opportunity to serve as a crucial bridge in EU’s eastern expansion and support for Ukraine.

Call for Action

Call for Action

To leverage Ukraine’s reconstruction opportunities, Slovak entities must engage in collaborative efforts. Stakeholders - including governmental bodies, businesses, academic institutions, regional authorities, business associations, chambers of commerce, and civil society organizations - need to work together to streamline processes, enhance financial support mechanisms, and promote effective public-private partnerships.

Key actions involve formalizing partnerships, developing tailored financial products to mitigate business risks, establishing strong connections with international and EU institutions, creating centralized information hubs, organizing training sessions, launching strategic PR campaigns, and creating a cross-border communication network with Ukrainian counterparts. These efforts will ensure Slovakia can effectively participate in Ukraine’s reconstruction, boosting regional development, economic integration, and fostering long-term prosperity and stability for both nations.

The Center for International Private Enterprise, with its Europe office based in Bratislava and through its office in Kyiv, stands ready to support private sector initiatives to better support Ukraine. CIPE aims to leverage its extensive partnerships with AmCham Slovakia and other associations, think tanks, and civic actors in Slovakia to amplify the voice of the private sector in public policy, forge close business connections with Ukraine, and contribute to peace and prosperity in the wider region.

_________

1 EURACTIVE: EU’s ‘Big Bang’ enlargement: How 10 countries transformed the EU

https://www.euractiv.com/section/enlargement-neighbourhood/news/eus-big-bang-enlargement-how-10-countries-transformed-the-eu/

2 GDP per capita, PPP (current international $), source: World Bank

3 European Council of the EU: https://www.consilium.europa.eu/en/infographics/eu-solidarity-ukraine/

4 ONE DATA & ANALYSIS: https://data.one.org/data-dives/ukraine-oda-tracker/

5 Council of the EU: https://www.consilium.europa.eu/en/press/press-releases/2024/05/14/ukraine-plan-council-greenlights-regular-payments-under-the-ukraine-facility/

6 The Council on Foreign Relations (CFR) https://www.cfr.org/article/how-much-us-aid-going-ukraine

7 The World Bank, the Government of Ukraine, the European Union, the United Nations: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099021324115085807/p1801741bea12c012189ca16d95d8c2556a

8 Eurostat: https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20240220-2

9 Strategic Engagement and Economic Reconstruction: Opportunities for Slovak Private Sector Involvement in Ukraine’s Recovery, a Research Report by CIPE

The Center for International Private Enterprise (CIPE) is a global organization that works to strengthen democracy and build competitive markets in many of the world’s most challenging environments. Working alongside local partners and tomorrow’s leaders, CIPE advances the voice of business in policy making, promotes opportunity, and develops resilient and inclusive economies. Established in 1983, CIPE is a non-profit affiliate of the U.S. Chamber of Commerce and a core institute of the National Endowment for Democracy. CIPE currently has more than 200 programs and grants in over 80 countries.

Dávid Bořuta, Executive Director and Senior Analyst, Future Slovakia Forum

Monika Kočiová, Program Officer for Europe & Eurasia, CIPE

Follow us