What to do with high inflation?

If inflation is a monetary phenomenon, as Mr. Friedman claimed, the solution is quite simple: adjust monetary policy accordingly. In “normal” times of high inflation, price increases are caused by the demand side, there is too much money chasing too few goods and the central bank can intervene to decrease the supply of money, which usually means increasing the interest rate. This does sound somewhat simpler than it actually is, but it is still much easier than what the central bank has to do today.

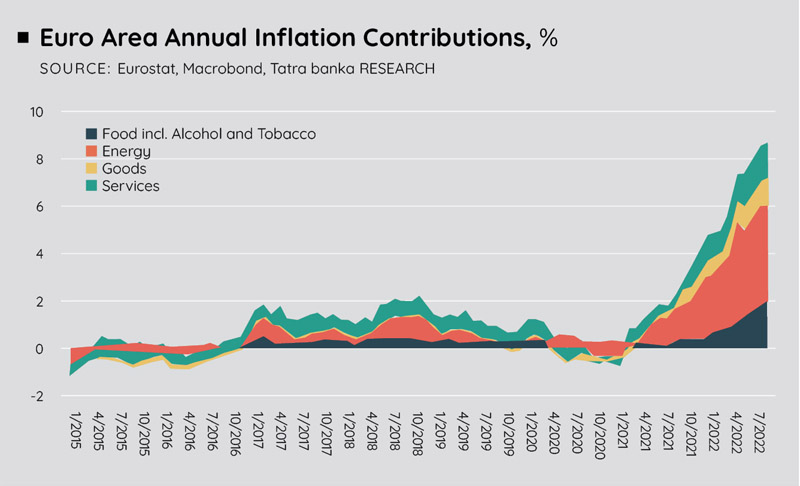

Current inflation is mainly caused by the war in Ukraine and the use of natural gas supplies as a geopolitical tool, there is some part of it that is demand driven. Even in the forecasts before the war, inflation and core inflation were expected to be above the 2% target. The problem for the ECB is, that because of the energy price shock, and second order effects - energy is a component of all other prices, thus if energy prices rise, all other prices rise as well - it is virtually impossible to say, how much of inflation is demand driven.

Why does it matter? If the ECB tightens its policy too much, it risks sending the euro area into an unnecessary recession. If it tightens it too little, inflation can become “unanchored”, that is, it might start to accelerate, driven by the demand side.

The energy shock can un-anchor inflation on its own

If only things were as simple as estimating the demand side contribution to inflation. The aforementioned second-order effects complicate matters further.

Because energy is an input for every other good and service in the economy, energy prices drive all other prices to some extent. The problem is that if energy prices rise too high for too long, inflation of all goods rises higher for longer, and this can un-anchor inflation.

What does “anchoring” mean? The concept is quite simple: if inflation is low and stable, firms and households can plan accordingly in the long term and can usually discount inflation altogether. With a 2% inflation, a ten-year projection makes sense even without taking inflation into account. If, however, firms and households do not expect stable and low inflation, they have to start adjusting their plans: if energy prices are expected to rise, companies have to budget price increases for their goods, households have to negotiate higher wage growth, and so on, leading to what is called a wage-price spiral, whence higher prices lead to higher wages, which in turn lead to higher prices still. The only way a central bank can stop a wage price spiral is to create a recession by tightening monetary policy. As recessions are undesirable, central banks try to avoid this scenario and work to keep inflation anchored at low and stable levels.

High energy prices do have the power to un-anchor inflation. As inflation is expected to stay higher for longer, firms and households will have to anticipate it and a wage price spiral may happen, even without demand driven inflation. On the positive side, there is still no concrete evidence that a wage-price spiral is starting in the eurozone, the risk is, however, non-negligible.

What can be done, then?

As the ECB has a very complicated problem on its hands, can the EU Commission or national governments help it? Yes and no.

To engineer a solution, we first have to know for how long the shock will persist. If it will fizz out in a year or two, governments can enact policies to ease or limit energy prices, with the expectation that they will return to either previous, or some normal levels quite shortly. In this case governments foot the interim higher energy bill, inflation does not rise (and subsequently falls) as much, and the ECB has a much clearer monetary policy target.

If, however, supplies of gas will never return to previous levels and prices are expected to stay high for long, a completely different solution is needed. Capping prices is no use, as governments will have to pay for the difference indefinitely. The smarter solution in this case is to let prices rise as they may, compensate the most exposed households and firms by sending them cash, and support building new, non-gas, energy infrastructure. While high prices are bad for most companies and households, they are the mover of Adam Smith’s invisible hand. High energy prices make clean energy investments more profitable, whether they are solar, wind, water, nuclear, or any other source. Furthermore, they create a powerful incentive to solve electricity storage issues, such as batteries, to fully reap the benefits of renewable energy. If high gas prices are here to stay, they also contain the seed of the solution, we just have to nurture it and reap it.

Tibor Lorincz, Economic Analyst, Tatra banka, a.s.

Follow us