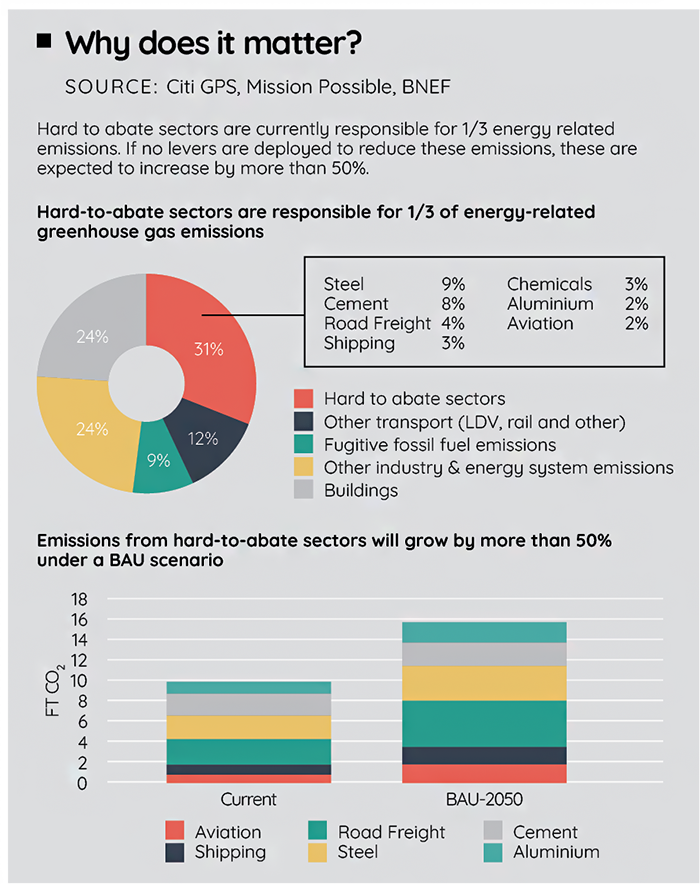

Today, hard-to-abate sectors such as steel, cement, aluminum, shipping, and aviation are responsible for more than one-third of energy-related greenhouse gas emissions when allocating emissions to different sectors. If no action is taken, emissions from these sectors could increase by more than 50% by mid-century. In many countries, hard-to-abate sectors are responsible for a large part of overall emissions.

How can hard-to-abate sectors decarbonize?

Energy efficiency, increasing the recycling and circularity of materials and better designs will not be enough to reach net-zero, so other supply side solutions are needed such as renewables and nuclear, clean hydrogen, carbon capture utilization and storage, and biomass.

However, the investment required to fund these solutions is high. Trillions of dollars are needed to scale up solutions to decarbonise these sectors. Our previous estimation for the cost of carbon abatement for steel, cement, aviation and shipping on our highest scenario basis not including aluminum was approximately $1.6 trillion annually.

But, spurred by government support, legislation, carbon pricing and a push from clients such as auto manufacturers and cargo owners wanting to reduce their scope 3 emissions, we are now seeing that decarbonization in hard-to abate sectors has started much sooner than expected.

So how can corporates finance their transition?

Currently, most of the financing for many of these projects is done on a corporate balance sheet, with the help of government support. In the past five years, a total of $80 billion in sustainable bonds has been issued by hard-to-abate sectors. Going forward, we expect this to increase.

However, the overall funding needed for the energy transition is such that corporates will not be able to finance all their needs on the balance sheet alone and will increasingly need project finance and other forms of financing. This is essential, especially in emerging and developing economies in which investment is muted.

Project finance is an option for many.

Project finance is the funding of long-term infrastructure, industrial projects and public services using a non-recourse or limited-recourse financial structure paid back from the project’s future cash flows.

The debt is referred to as non- or limited-recourse debt because lenders can only pursue the collateral and nothing else. However, lending rates are often higher than traditional corporate finance structures because of it.

Usually, a standalone company known as a special purpose vehicle (SPV) is formed and investors are often sought from private equity, sovereign wealth funds, and pension funds. Sometimes, industrial sponsors known as ‘offtakers’ are involved.

For example, for the NEOM Green Hydrogen project, the offtake of the fuel was secured for 30 years by a company that had a stake in the SPV. This reduced offtake risk and guaranteed a steady revenue stream for the project. The H2Green Steel project also had offtakers, which enabled project financing to be finalized. These offtakers included European car manufacturers such as BMW, as well as Kingspan, Bilstein Group, Marcegaglia and Scania.

Other forms of project finance could include government grants, for example, through the EU Innovation Fund, while Export Credit Agencies (ECAs) could provide government-backed guarantees or insurance for loans extended by banks to entities buying the goods and/or services from the ECA home country.

Joint ventures, equity raising and carbon credits.

Companies can also form joint ventures and invest together in solutions. For example, Alcoa, an aluminum producer, is co-investing alongside Rio Tinto, Apple and the Canadian and Quebec governments in the ELYSIS carbon-free aluminum project. This project aims to produce inert anodes in replacement of carbon-anodes used today in aluminum smelting. This will enable this process if coupled with renewable power to become carbon neutral.

Other forms of financing – such as equity and carbon credits – are possibilities, too. For companies starting their journey, equity funding from venture capital or private equity companies is typically their first stop.

Traditionally, investment banks have become involved with equity raising at the initial public offering stage, although some banks are also helping scale up new innovative solutions through impact funds or advisory, and in some cases direct funding to companies that are more established in their journey.

Other forms of financing besides equity raising are the use of carbon credits either through the voluntary or compliance markets. For example, Frontier is a marketplace that acts on behalf of both buyers and sellers. It has committed to buy an initial US$1 billion of permanent carbon removal between 2022 and 2030.

Finding your own pathway

Whether a company chooses to fund decarbonization projects on balance sheet, via project finance, joint ventures or equity raising, the reality is that there are several pathways available to fund the journey to net zero.

Elizabeth Curmi, Head of Climate Finance & Energy Transition, Citi Global Insight

Follow us