Changes in the HR and payroll area

MEAL ALLOWANCE

Due to high inflation, as of January 2023, there will be another increase in the meal allowance, which is derived from the amount of the domestic travel rates which will be as follows:

- € 6.80 – time zone 5 to 12 hours,

- € 10.10 – time zone 12 to 18 hours,

- € 15.30 – over 18 hours.

Based on that, following amounts will apply :

- maximum value of the meal voucher € 6.80

- maximum employer contribution per meal voucher € 3.74

- minimum value of the meal voucher € 5.10

- minimum employer contribution per meal voucher € 2.81

In case the employer provides a financial contribution to the employees, the following amounts will apply:

- minimum value of the financial contribution = € 2.81

- maximum value of the financial contribution = € 3.74

Paper meal vouchers should no longer be used and the employers should provide electronic cards instead. The only exception is when the usage of such an electronic card is not possible (no restaurants accept the cards in the close proximity of the employer). Please be also reminded that:

- the financial contribution/meal vouchers can also be paid by the employer from the social fund, without limit

- meal vouchers and financial contribution for meals are provided in advance

- employee can still choose between financial compensation or the meal card

PREMIUMS FOR WORK ON SATURDAY, SUNDAY, NIGHT AND HOLIDAYS

Despite the increase of the minimal wage as of January 2023, most of the premiums will not change. The only premium that will increase from January 2023 is the premium for inactive work at the workplace, as this increase is tied to the amount of the minimum hourly wage.

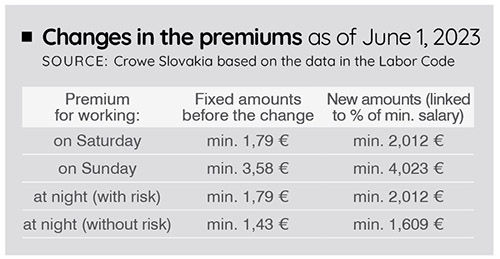

However, due to a change of the methodology of the calculation of the premiums, the premiums will be increased as of June 2023. Whereas for the last two years the premiums were in the fixed amount, as of June 2023 they will be linked to the amount of the minimum hourly salary. The impact will be as follows:

Changes in the tax legislation

TAX BONUS FOR CHILDREN

The tax bonus for children will be increased as of January 2023. This will be its second increase in a short time, as it was already increased in July 2022.

The following amounts will apply:

- children under 18 years = € 140 (for a period of two years),

- children over 18 years = € 50.

The calculation of the tax bonus is rather complicated and some parents may not get the above stated tax bonus (especially people with lower salaries, people working on part time contracts or self-employed people).

The income of both parents will be taken into account and if the parent cannot claim the full amount of the tax bonus during the year, he/she will be able to do so when submitting a tax return in which he/she will also state the partial tax base of the other parent. When their combined partial tax base is sufficient, they can claim the full amount.

REDUCTION OF THE VAT IN GASTRO SECTOR

The Ministry of Finance has proposed a reduction of the VAT rate in the gastro sector and sport venues. The reason is that these were sectors which suffered a lot during the Covid-19 pandemic. The VAT will be reduced from January 1 2023 from the current 20 percent to 10 percent for the period of three months. Despite the fact that many restaurants, ski parks, or swimming pools welcome this change, there is criticism that the reduction is planned only temporarily from January till March which is very often the slowest season.

The reduced VAT will only apply to the restaurants which – besides meals – also offer “the service”. So this reduced VAT does not apply “to deliveries” and sales “through the window”. It only applies for consumption inside the restaurant area.

OTHER CHANGES IN THE TAX AREA:

- VAT of 5 % is introduced for the construction of rental housing

- For dependent transactions up to the amount of € 10,000 or € 50,000 principal (loans), it will no longer be necessary to have transfer pricing documentation.

- A new option of a correction of the tax base in the case of uncollectible VAT is being added, subject to the condition that 150 days have passed since the claim is due.

- In order to prevent tax evasion of income from commercial bonds, a tax on interest from bonds for non-residents is being introduced. There will be a possibility to treat the tax withheld from bond proceeds as an advance. It should ensure equal treatment compared to domestic legal entities.

- In connection with the current energy crisis, excess income levy for electricity producers and traders was imposed. The levy amount is set at 90 percent of excess income. The levy periods are individual calendar months from December 1, 2022 to December 31, 2024.

This section was prepared by experts from Crowe Slovakia, their accounting, tax, audit, and payroll services can be found at: www.crowe.com/sk

Follow us