Changes in the area of VAT

The parliament passed a permanent VAT reduction for the gastro and tourism sector in the amount of 10 %. Initially, the VAT reduction had been approved for only three months, which was changed by the last amendment to the law. At the same time, the tax on alcohol was increased by 30 % and the levy on gambling is now in the amount of 27 %.

Another change is that the entities that provide only VAT exempted services (e.g. § 37 - § 39 – insurance, financial services and delivery and rental of real estate) will no longer have to register for the VAT purposes even if they exceed EUR 49,790. This is to lower the administrative burden.

Abolishment of the concessionaire fees of RTVS

The concessionary fees for radio and television were cancelled and will not have to be paid from July 1, 2023. The purpose of the payment was the financial security of public services in the field of radio broadcasting and television broadcasting. Those companies that already paid the fee for the entire year can apply for a refund. RTVS will be funded from the state budget.

HR and Payroll

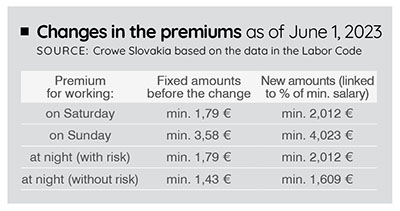

As of June 1, 2023, new premiums for work on Saturday, Sunday and work at night will be in place. The employers are obliged to pay these premiums:

In certain cases, a reduced premium can also be negotiated but only if the nature of the work or the operating conditions of the employer require the work to be regularly performed on Saturdays, Sundays or at night and can only be agreed in a collective agreement or an employment contract.

Income taxes – important deadlines

- Tax Return – companies and self-employed people (SZČO)

in case the fiscal year ends December 31, 2022, the deadline for the submission of Tax Return is March 31, 2023.

in case a prolongation is desired, the taxpayer needs to submit the notification to the local tax office in paper form or electronically no later than 31st March 2023 – in such a case the deadline is extended by a maximum of three months (till June 30, 2023). The tax is also payable within this period.

- Tax Return – employees

Employers need to process the Annual Tax Reconciliation (ATR) for all employees that were eligible for ATR and submitted the requests by February 15th, 2023 – the ATR needs to be processed in March payroll at latest.

Those employees that had an income from other activities (leasing of apartment, income from abroad, business activities, etc.) must submit the Tax return on their own by March 31, 2023.

Employers are obliged to submit Annual Tax Statement (“Hlásenie“), which is a report on the tax statement and the total income from dependent activity, the deadline is the end of April 2023.

In both cases, the companies and the employees can donate a proportion of their taxes to the non-profit organization of their choice.

Employers that employ over 20 employees also need to submit the Annual report on fulfillment of the mandatory share of employment of citizens with disabilities by March 31, 2023.

Changes in the area of Transfer Pricing

The amendment of the law has brought several changes in the transfer pricing regulations. These are the most significant ones:

- Regarding the calculation of the direct share, indirect share or indirect derived share: the shares of “related” persons will be counted and if their sum is at least 25%, the relevant persons or entities will be considered economically connected.

- A significant controlled transaction is more precisely defined – this is to reduce the administrative burden on small companies. According to the new definition, a significant transaction is considered a transaction with a value of EUR 10,000 or more (in the case of loans, EUR 50,000 principal). Transfer pricing rules will not apply to insignificant transactions. However, it should be noted that this is not a change in the definition of significance with which the Ministry of Finance SR works in the Guidelines for determining the scope of the documentation obligation.

- The amendment makes it possible to submit transfer documentation to the tax administrator in a foreign language. Until now, it was necessary to apply for this exemption to the tax administrator in advance. At the same time, the tax administrator still has the option of asking the taxpayer to submit documentation in Slovak language.

- The amendment makes a direct reference to the methodology of the OECD Transfer Pricing Directive for multinational companies and tax administration, which is generally considered an interpretative tool. Adding the appeal to the law increases legal certainty in its application and in tax audits.

- In case of detection of inconsistencies with the arm´s length principle, during the tax audit, the tax administrator will charge the difference to the taxpayer up to the median value. Until now, the value at which the tax administrator should have calculated the difference has not been precisely defined.

***

This section was prepared by experts from Crowe Slovakia, their accounting, tax, audit, and payroll services can be found at: www.crowe.com/sk

Alena Lipovská, Country manager, Crowe Slovakia

Katarina Durilová, Tax Consultant, Crowe Slovakia

Follow us