His presentation confirmed one of the key messages of the conference: GBS is no longer a back-office function, but a strategic enabler shaping how organizations compete, innovate, and build resilience.

The survey captures the pulse of GBS organizations in 2025, a moment defined by geopolitical uncertainty, economic pressure, and rapid AI disruption. The central question posed was clear: “With geopolitical and economic uncertainty and AI disruption, we’ve never been in a more dynamic environment – so isn’t this the ideal opportunity for GBS to prove its value?” According to PwC’s findings, the answer is yes.

From cost center to capability center

GBS has undergone a profound transformation. What began as a model focused on efficiency and cost reduction has matured into a value-generating engine embedded at the heart of business operations. Leading GBS organizations today do far more than optimize processes. They manage risk, enable productivity through technology, incubate new capabilities, enhance customer experience, and generate insights that influence strategic decision-making.

While cost, quality, and capacity remain core objectives, organizations are now leveraging a fourth dimension: capability. GBS increasingly acts as a platform for innovation and transformation, helping companies adapt their operating models to remain competitive and sustainable.

Expanding scope and strategic relevance

One of the most visible changes highlighted in the survey is the growing appetite to move more strategic and enabling functions into GBS, effectively transforming them into global capability centers. In parallel, some previously outsourced processes are being brought back in-house, supported by automation and advanced analytics that improve control and efficiency. GBS scope expansions increasingly include areas such as supply chain services, commercial functions, research and development, analytics and business intelligence, ESG reporting, and IT centers of excellence.

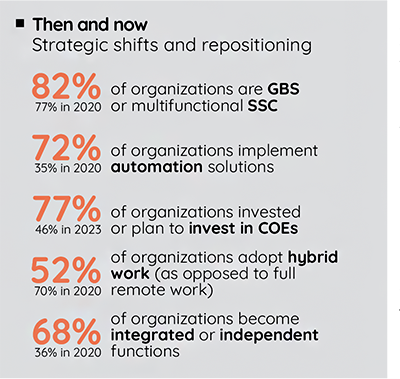

Strategic shifts and repositioning

The survey shows that GBS is no longer merely executing strategy – it is increasingly helping to shape it. Fifty-seven percent of GBS organizations are either involved in or actively driving the development of strategic initiatives and targets, signaling a fundamental repositioning within enterprises. This trend reflects growing confidence in GBS capabilities and reinforces its role as a trusted partner to senior leadership. In many organizations, GBS now holds the largest pool of enterprise data, positioning it as a natural hub for analytics, insights, and productivity gains.

Rethinking location strategies in a volatile world

Rethinking location strategies in a volatile world

Location strategy is another area undergoing recalibration. Traditional cost arbitrage is narrowing due to competition and technology, while talent requirements are evolving rapidly toward higher-value skills. At the same time, geopolitical and economic volatility is reshaping risk considerations.

Rather than aggressive geographic expansion, organizations are focusing on optimizing and scaling existing hubs. According to the survey, 83% of companies plan to strengthen their current GBS locations, and nearly half intend to adopt hybrid delivery models combining onshore, nearshore, and offshore elements. Nearshoring remains attractive despite proximity factors being rated relatively low in isolation, contributing to the rise of multi-hub models.

Digital enablement: beyond the hype

Digital transformation remains at the core of GBS evolution. Mature GBS models exhibit significantly higher transformational capacity than single-function setups. While enthusiasm for AI may echo previous technology hype cycles, PwC notes a key difference: AI’s impact is already tangible and measurable. Moving to enterprise-wide adoption will test organizational readiness, governance, and the ability to keep pace with rapid technological change.

People, culture, and the future workforce

At the heart of transformation sits talent. The survey highlights people and culture as decisive factors in GBS success, particularly as organizations navigate new work models and evolving employee expectations.

GBS leaders increasingly recognize that productivity, engagement, and innovation depend on trust, flexibility, and continuous skill development. Hybrid work models, inclusive leadership, and a strong learning culture are becoming essential to attract and retain talent capable of driving future-ready operations.

Looking ahead

The key message from PwC’s 2025 GBS Survey is clear: GBS stands at a defining moment. It holds the data, the technology, and the cross-functional reach to shape the future operating model of organizations. Those that embrace this role – investing in people, digital capabilities, and strategic leadership – will move beyond efficiency toward sustained competitiveness.

As discussed throughout the BSCF conference, trust, talent, and technology are not separate themes. In the GBS context, they determine whether GBS becomes a support function of the past or a strategic engine of the future.

You can download the full presentation on: www.amcham.sk

PwC

Follow us