The survey, conducted by AmCham Slovakia in 2025 among 41 business service centers that were active members of the BSCF community at the time, reflects the status quo of the industry as of October 1, 2025. Its findings provide not only a quantitative overview of employment, structure, and economic impact, but also valuable insights into how global trends, from geopolitics to artificial intelligence, are reshaping the sector in Slovakia.

A Strategic Pillar of the Slovak Economy

The importance of the business service centers for the Slovak economy is no longer questioned. The sector has evolved into a core contributor to Slovakia’s competitiveness, generating high-quality jobs, advanced services, and significant fiscal revenues.

In 2025, the surveyed BSCF members collectively employed more than 35,000 people, making the sector one of the largest white-collar employers in the country.

Beyond employment, the economic contribution of the sector is substantial. BSCF member companies generate approximately 3% of total Slovak government income, contributing over €800 million in state taxes annually and spending more than €1.1 billion on gross salaries. These figures clearly illustrate why business service centers matter to the country’s overall fiscal stability and growth.

Who Works in Slovak Business Centers?

The survey sheds light on the people behind these numbers. The average age of employees in business service centers is 37.5 years, a figure that has been steadily increasing since 2015. This reflects both the maturation of the sector and the growing share of experienced professionals in higher-value roles.

Education levels remain high: 61% of employees hold a university degree, confirming the sector’s role as a magnet for skilled talent. At the same time, business centers continue to operate with lean management structures, only 10% of employees hold people management positions, highlighting a strong emphasis on expertise, specialization, and individual contribution.

From a diversity perspective, the sector remains balanced and inclusive. Women account for 47% of the workforce, and while business centers predominantly employ Slovak citizens, 9% of employees are foreigners, with EU nationals slightly prevailing. This international mix supports knowledge transfer, language diversity, and integration into global operations, while still being deeply anchored in the local labor market. However, the limits of the local labor market, especially for highly specific positions, in combination with the administrative complexity of hiring third-country nationals, count among the biggest challenges of the sector.

Mature Centers, Advanced Services

One of Slovakia’s distinguishing features within the Central and Eastern European region is the high concentration of large and extra-large business centers. A significant number of BSCs in Slovakia employ more than 1,000 people, reflecting long-term investment decisions and confidence in the country as a stable location for complex operations.

Slovak BSCs are predominantly mature operations delivering value-added and sophisticated services for global and regional markets. Almost 80% of all services fall into three advanced domains:

- Customer Operations (including sales, fulfillment, technical support, and customer care),

- Financial Services, and

- IT Services.

This profile aligns with discussions at the BSCF Conference, where speakers emphasized the transition from traditional shared services models to strategic capability centers embedded in core business transformation.

A Year of Adjustment, Not Decline

The 2025 survey also captures a year of adjustment. Compared to the previous year, total employment among surveyed companies declined by approximately 5% (around 1,900 positions). However, this modest reduction must be viewed in context.

Rather than signaling a structural downturn, the data reflects ongoing productivity gains, automation, and role transformation. While headcount growth has slowed, investment in skills, technology, and compensation continues. The average salary in the sector increased by around 11% (€280), reaching €2,826, confirming that companies are prioritizing higher value roles and competitive remuneration.

Two new organizations joined the BSCF community in 2025, further reinforcing the sector’s long-term relevance. One of the new members was the Bratislava Shared Services Center, a particularly valuable addition to the BSCF community, underscoring that the shared services model is gaining relevance not only in the private sector, but also within the public sphere.

Automation, AI, and the Changing Nature of Work

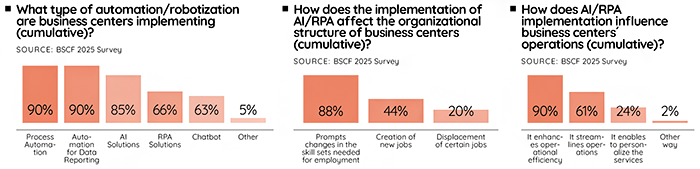

One of the most prominent themes at the BSCF Conference, and across the survey results, is the acceleration of automation and artificial intelligence. AI and automation are now described by companies as being “everywhere,” moving beyond pilots and proofs of concept into everyday operations.

AI agents are beginning to emerge, supporting research, data processing, and operational efficiency. However, as discussed during conference panels, technology is not replacing people - it is reshaping roles. Employee skill requirements are evolving rapidly, with growing emphasis on critical thinking, adaptability, and the ability to work alongside intelligent systems.

This shift reinforces the sector’s transformation from scale-driven growth toward productivity, quality, and innovation-led value creation, a trend echoed throughout the conference discussions on competitiveness and future readiness.

As AmCham Slovakia’s BSCF Coordinator Peter Rusiňák pointed out, this transformation is visible across several dimensions. Business centers are moving beyond a narrow focus on operational KPIs toward delivering measurable business impact. They are evolving from traditional cost centers into engines of genuine value creation, and from well-managed process owners into accountable partners with ownership of outcomes. This is not a short-term trend, but a long-term journey the sector has already begun, one that is reshaping both expectations and the role of business services within global organizations.

Why the BSC Sector Matters, Now More Than Ever

Taken together, the BSCF survey results and conference discussions paint a clear picture: the business services sector is not only a major employer, but a strategic asset for Slovakia’s competitiveness.

It connects Slovakia to global value chains, anchors high-skilled jobs in the country, generates significant public revenues, and drives the adoption of advanced technologies and management practices. At a time of geopolitical uncertainty, technological disruption, and pressure on Europe’s competitiveness, the resilience and adaptability of the BSC sector stand out as a success story.

As BSCF Chair Marek Chudík noted during his presentation, the challenge ahead is not whether the sector will survive but how it will continue to evolve, upgrade its value proposition, and help position Slovakia as a future-ready economy. The 2025 BSCF survey confirms that while the sector is changing, it remains strong, relevant, and deeply embedded in Slovakia’s economic future.

***

You can download the full brochure here: https://amcham.sk/download.pl?hash=sQInf2sHB3YLB8PrKDQt6YpDeuCOtyQm&ID=7187

***

The presence and importance of business service centers (BSCs) in Slovakia have been growing for more than two decades. Nowadays, 41 BSCF member companies represent the third largest industry with more than 35k highly skilled experts in Slovakia providing global high value-added complex services.

bscf.eu

The Business Services Center Forum (BSCF)

Follow us